A Biased View of Paul B Insurance Medicare Part D Huntington

Wiki Article

Getting My Paul B Insurance Medicare Agency Huntington To Work

People with end-stage renal illness became eligible to sign up in any local Medicare Advantage plan in 2021. People with end-stage kidney condition (ESRD) ended up being qualified to authorize up for any kind of Medicare Advantage strategy in their area in 2021. ESRD people should compare the expenses and benefits of Medical Benefit prepares with those of typical Medicare insurance coverage, and also make certain their physicians as well as healthcare facility are in the strategy's carrier network.

For family members insurance coverage, the 2023 out-of-pocket maximum is $18,200, up from $17,400 in 2022. Medicare Celebrity Ratings are made to aid seniors contrast Medicare Benefit intends when choosing which intend to register in. They vary from one to 5 stars, with one being the most affordable rating as well as 5 celebrities the highest.

They commonly offer lower premium expenses as well as cover even more solutions than traditional Medicare, while limiting like in-network suppliers and also needing references for consultations with specialists. Medicare Advantage can become pricey if you're unwell, as a result of co-pays. The registration duration is limited, and you won't be qualified for Medigap coverage if you have Medicare Advantage.

Paul B Insurance Medicare Advantage Plans Huntington - The Facts

Yes. Medicare Advantage supplies protection for individuals with pre-existing problems.

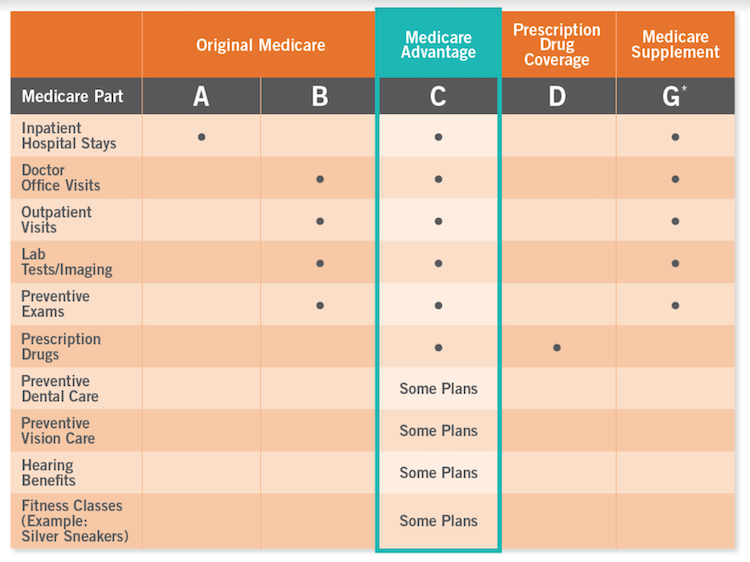

Consider a Medicare Benefit plan as thorough protection for your healthcare requires. A few of the benefits most Medicare Benefit strategies have that Original Medicare does not have include: Medicare Benefit prescription medication (MAPD) plans are Part C intends combined with Component D prescription medication strategies. While Medicare Part D gives only prescription medicine protection, Medicare Advantage plans can be combined to cover that and much more.

You receive all Medicare-covered benefits with the exclusive MA strategy you select. Some MA intends offer Medicare prescription medication protection (these are called MA-PD plans), but other plans do not (these are referred to as MA-only strategies). If you join an MA-only strategy, you may or may not join a different Medicare Component D strategy depending upon the type of MA prepare you join.

How Paul B Insurance Medicare Part D Huntington can Save You Time, Stress, and Money.

If hospice insurance coverage is not used through your MA strategy, you can access it independently via Initial Medicare., we have actually assembled information on the 3 sorts of Medicare Advantage prepares: Some employer-sponsored and also retired person plans offer wellness insurance coverage through MA strategies. See Medicare & Other Health Insurance to learn more.

Most most likely, neither your HMO plan nor Medicare will cover the expense. Some HMOs provide Medicare Part D prescription medication protection and others do not.

HMOs are the most popular type of MA strategy in California, yet they are not offered in every component of the state. In 2023, 52 areas have at the very least one HMO plan. The areas with no HMO include: Alpine, Calaveras, Colusa, Lassen, Sierra and Trinity.

The Main Principles Of Paul B Insurance Medicare Agency Huntington

Medicare PPOs like Medicare HMOs have networks of carriers. If you see companies in the network, you will certainly pay a lower copayment than if you most likely to service paul b insurance Medicare Advantage Agent huntington providers outside the network (these are called out-of-network or non-preferred). If you see carriers outside the network, the strategy still covers you but you pay greater cost-sharing than if you see network suppliers.

Understood as Medicare Part C, Medicare Advantage strategies are used by exclusive insurance firms that have been approved by Medicare.

Private fee-for-service, or PFFS, strategies: Permit you to see any type of Medicare-approved health care service provider as long as they approve the plan's repayment terms and concur to see you. You may likewise have access to a network of companies. You can see doctors that do not accept the strategy's repayment terms, but you may pay even more.

Rumored Buzz on Paul B Insurance Medicare Health Advantage Huntington

The plans you can pick from will rely on your postal code and also region. While you could not have a great deal of Medicare Advantage options if you live in a backwoods, city dwellers could have two dozen or more options readily available. Slim the area with these strategies: Find the star score.

"It's based upon efficiency on a variety of different points to do with top quality, consisting of points like, 'Just how receptive is the strategy to any kind of problems or concerns?'" states Anne Tumlinson, CEO of healthcare study and also consulting company ATI Advisory. The star rating goes from 1 to 5 stars, with 5 stars being exceptional.

The two main cost considerations are a strategy's costs and also the maximum out-of-pocket price, which is one of the most you'll pay in a year for covered healthcare. The strategy optimum can be as high as $8,300 expense in 2023, where plans with reduced out-of-pocket maximums have higher costs.

Unknown Facts About Paul B Insurance Medicare Agency Huntington

Prior to you shoot on a strategy, go to the provider's internet site as well as make certain you comprehend all the advantages and also constraints. "What we're seeing is that plans are offering these new and different benefits, like in-home palliative care," Tumlinson says. Those are interesting and, if you have a demand, they're something to consider.

If you have any type of inquiries about the process, you can reach the individuals at Medicare at 800-MEDICARE (800-633-4227), or you can locate information at Medicare. gov. Compare leading plans from Aetna, Chapter is an accredited Medicare broker, partnered with Nerdwallet. Contrast inexpensive Medicare plans from Aetna with Chapter, free of cost, Learn more about the different components of Medicare and what they cover.

Report this wiki page