Medicaid Things To Know Before You Buy

Wiki Article

The Best Strategy To Use For Travel Insurance

Table of ContentsCar Insurance Quotes Fundamentals ExplainedThe 6-Minute Rule for Home InsuranceSee This Report about Cheap Car InsuranceFacts About Car Insurance Revealed

You Might Want Special Needs Insurance Coverage Too "As opposed to what lots of people believe, their home or automobile is not their biggest possession. Rather, it is their capacity to make an earnings. Yet, many specialists do not insure the opportunity of an impairment," claimed John Barnes, CFP and owner of My Domesticity Insurance, in an e-mail to The Balance.

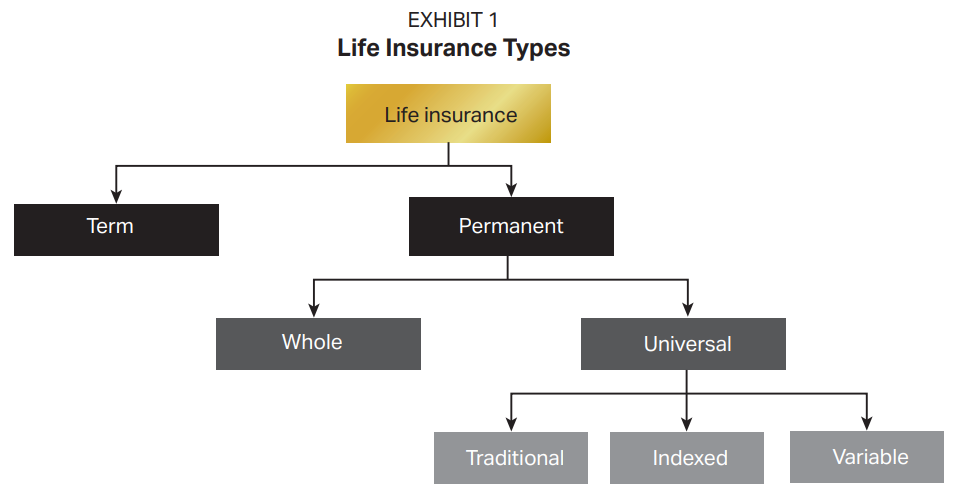

The info below focuses on life insurance policy sold to individuals. Term Term Insurance coverage is the easiest kind of life insurance policy. It pays only if death takes place during the regard to the plan, which is generally from one to three decades. Many term policies have nothing else benefit arrangements. There are 2 basic kinds of term life insurance plans: degree term and reducing term.

The expense per $1,000 of advantage rises as the guaranteed individual ages, as well as it obviously obtains really high when the guaranteed lives to 80 as well as beyond. The insurance provider can charge a costs that enhances every year, yet that would certainly make it extremely hard for most individuals to pay for life insurance policy at sophisticated ages.

The smart Trick of Car Insurance That Nobody is Discussing

Insurance coverage are created on the concept that although we can not stop unfavorable events occurring, we can protect ourselves monetarily against them. There are a vast variety of various insurance coverage plans offered on the marketplace, as well as all insurance companies attempt to convince us of the qualities of their specific product. A lot so that it can be challenging to determine which insurance policies are really essential, and which ones we can genuinely live without.Researchers have actually found that if the main breadwinner were to die their household would only be able to cover their family expenses for just a few months; one in 4 family members would certainly have troubles covering their outgoings promptly. Many insurance providers recommend that you get cover for around ten times your annual income - medicaid.

You ought to likewise factor in child care expenditures, as well as future university fees if relevant. There are 2 major kinds of life insurance policy plan to pick from: whole life plans, and also term life policies. You spend for whole life policies till you die, and also you spend for term life policies for a set time period identified when you take out the policy.

Medical Insurance, Health And Wellness insurance coverage is an additional among the four primary types of insurance policy that professionals suggest. A recent study exposed that sixty 2 percent of personal insolvencies in the US in 2007 were as a straight outcome of illness. A shocking seventy 8 percent of these filers had medical insurance when their ailment began.

The Single Strategy To Use For Travel Insurance

Premiums vary significantly according to your age, your existing state of wellness, and your way of life. Automobile Insurance coverage, Rule differ in between different countries, however the significance of auto insurance policy continues to be constant. Also if it is not a lawful requirement to secure vehicle insurance where you live it is extremely advised that you have some kind of policy in location as you will certainly still need to assume economic obligation in the situation of an accident.Furthermore, your car is usually among your most beneficial assets, as well as if it is harmed in a crash you may struggle to pay for repair work, or for a replacement. You could additionally visit our website find on your own responsible for injuries sustained by your passengers, or the motorist of one my link more automobile, and for damages created to one more automobile as a result of your oversight.

General insurance covers residence, your travel, vehicle, and health and wellness (non-life assets) from fire, floods, accidents, manufactured catastrophes, and also burglary. Various kinds of general insurance consist of electric motor insurance, medical insurance, travel insurance policy, and also house insurance coverage. A general insurance plan spends for the losses that are incurred by the guaranteed throughout the duration of the policy.

Read on to understand even more concerning them: As the house is a beneficial belongings, it is vital to safeguard your home with a correct. House as well as house insurance coverage safeguard your home and the items in it. A home insurance plan basically covers man-made as well as natural conditions that may lead to damages or loss.

The Best Guide To Insurance

It can be found in 2 types, third-party as well as thorough. When your lorry is in charge of a crash, third-party insurance policy deals with the harm caused to a third-party. You have to take into account one fact that it does not cover any of your lorry's problems. It is additionally crucial to note that third-party motor insurance policy is obligatory as per the Motor Autos Act, 1988.

When it comes to health and wellness insurance policy, one can opt for a standalone health and wellness policy or a family advance strategy that provides protection for all family members. Life insurance policy gives coverage for your read the full info here life.

Life insurance policy is various from basic insurance coverage on numerous criteria: is a short-term agreement whereas life insurance policy is a long-lasting contract. When it comes to life insurance coverage, the advantages and the amount guaranteed is paid on the maturation of the plan or in the event of the plan owner's death.

They are nonetheless not mandatory to have. The general insurance cover that is necessary is third-party liability cars and truck insurance coverage. This is the minimal coverage that a vehicle should have before they can ply on Indian roadways. Every single kind of general insurance coverage cover features a purpose, to offer protection for a certain element.

Report this wiki page